Why DeFi Perpetuals Are Different — And How To Trade Them Without Losing Your Shirt

Whoa! Perpetuals feel like magic until they don’t. They let you hold synthetic exposure forever, with leverage, and that promise grabs traders — fast. My first reaction was: this is too good to be true. Seriously? Then reality set in. Funding payments, oracle quirks, and liquidity dynamics all conspire to make a simple long into a slow bleed if you’re not careful. My instinct said: watch the funding. But that’s only the start…

Okay, so check this out—perpetual swaps on decentralized exchanges are not just “futures that never expire.” They are a system of incentives. Short-term moves are amplified by leverage; long-term moves are tempered by funding. On one hand they democratize access to leverage. On the other hand they expose traders to on-chain idiosyncrasies that CEX users rarely see. Initially I thought CEX risk was the biggest issue, but then I realized the smart-contract and oracle layer add whole new failure modes.

Here’s what bugs me about many beginner guides: they treat liquidation as binary. It’s not. Liquidations are messy, expensive, and often socialized. There are insurance funds, auto-deleveraging (ADL) mechanisms, and sometimes the DEX will eat the loss via liquidity providers. Those mechanisms matter because they change how profit and loss actually materialize over time. I’m biased, but I think traders underestimate tail risk. Really underestimated.

Core mechanics — quick, then deep

Funding is the heartbeat. Short pays long, or long pays short, every funding interval. Keep leverage high when funding favors you and you feel invincible. The market, though, flips. Funding can flip fast. Boom—your P&L changes not just by price moves but by the cumulative funding stream. Something felt off about that the first time I sized a position without checking the funding calendar. Oops.

There are two dominant design families for DEX perpetuals: orderbook-like systems and AMM-based perpetuals. Orderbooks on-chain are expensive. AMM perpetuals borrow from automated market makers and embed a virtual price curve to simulate leverage. Each design has tradeoffs. AMMs are capital efficient but tend to have convexity that hurts large directional bets. Orderbook designs can support deep limit liquidity but they rely on off-chain relayers or optimistic execution, which introduces latency and front-running risks.

Funding, again, is determined differently across implementations. Some use mark price vs index price. Some compute oracle feeds via a single provider, others use aggregated TWAPs. Oracles are the Achilles’ heel. If the price feed breaks, so does the risk model. On one chain, a manipulated oracle once allowed a bad actor to liquidate positions cheaply; on another, a stale TWAP meant the insurance fund took the hit. Not all oracles are created equal. Choose wisely.

Liquidity providers deserve a shout-out. They shoulder impermanent loss and funding volatility. Many AMM perpetuals subsidize LPs with token emissions. That helps, but the subsidy can be unsustainable. On the flip side, deep native liquidity—often provided by professional market makers—reduces slippage and helps with large closes. However, when liquidity dries, something ugly happens fast: cascading liquidations.

Risk vectors you need to know

Liquidation mechanics differ. Some DEXs use on-chain auctions and keep them slow-ish to ensure fairness. Others rely on liquidators to compete for a quick scalp. That competition is healthy until it becomes a zero-sum race where everyone pays gas to push prices against you. Either way, slippage and fees can turn a “near-miss” into a wiped position. Hmm… not fun.

Oracle manipulation is real. Short attacks on oracle feeds or sandwich attacks around large trades can distort perceived mark prices. MEV (miner/validator extractable value) shows up as front-running, back-running, and sandwiching. Sometimes you get lucky and the block builder helps you; sometimes you pay the toll. Initially I thought wrapping trades with relayers would dodge MEV, but actually, wait—let me rephrase that: relayers can reduce some on-chain pain, yet they also create new centralization points.

Cross-margin vs isolated margin is another big call. Cross margin pools risk across positions, which is efficient but increases contagion. Isolated margin limits exposure per position, which feels safer emotionally, though it forces more capital to be posted for the same aggregate exposure. On one hand cross-margin reduces required capital. On the other hand it can wipe accounts during systemic crashes. Trader choice here reflects risk appetite more than pure math.

Smart contract risk is always lurking. Audits help, but they don’t eliminate logic bugs. Protocol upgrades, admin keys, and timelocks can all change the rules mid-game. I’ve seen governance proposals change fee structures overnight, which is legal but painful. If you’re not paying attention to governance, you might be trading under a different set of rules next week.

Practical trading playbook — human but rigorous

Trade less like a gambler, more like an engineer. Break your approach into three layers: position sizing, execution, and contingency planning. Short sentences help me think: size matters. Use small notional exposure at first. Build into a position. Scale out when you’re proven right. Sounds obvious, yet people still flip full size in one go.

Leverage is a multiplier of both gains and chaos. At low leverage, funding dominates your carry. At high leverage, liquidations dominate. If funding is positive for your side, you may be tempted to max leverage. Don’t. Buffer for adverse funding trends. Consider hedging with spot or inverse positions on a different venue to reduce pure directional risk. Hedge imperfectly—perfect hedges cost too much and restrict upside.

Execution matters. Use limit orders when possible. Slippage is stealth tax. For big entries, use TWAP or sliced limit strategies to avoid moving the market and giving MEV bots a feast. If you’re on an AMM perpetual, plan for price impact curves and target price depths. I’ll be honest: I sometimes overoptimize entries. That bugs me, but better that than eating a 2% slippage on entry with leverage.

Keep an eye on funding and liquidity incentives. When a protocol launches high token emissions to attract TVL, favorable funding can flip quickly once emissions taper. That’s a recurring pattern—liquidity rush, calm, then a rush out. Don’t get stuck holding a leveraged long when liquidity incentives evaporate. Somethin’ like that happened to a friend; they learned fast. Very very painful lesson.

DeFi-native tools and defenses

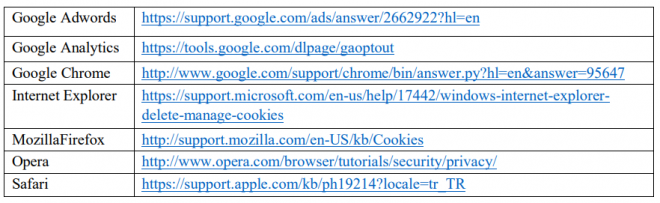

Use better oracles and diversify feeds where you can. Some advanced DEXs let you pick between TWAP, Chainlink, and Pyth. If given a choice, prefer diversified index constructions that resist single-provider manipulation. Also, prefer protocols with transparent insurance funds and clear ADL policies. You want rules you can read, not promises you have to guess about.

Consider using relayers and batch auctions to reduce MEV. Protecting yourself from sandwich attacks sometimes means accepting slightly higher execution latency in exchange for less front-running. It’s a trade—literally. And no solution is perfect; I’m not 100% sure any one approach will always win. But layering defenses usually helps.

If you want a practical on-ramp to try these ideas, I often point traders toward strong DEXs that focus on perpetual design and robust risk controls. One platform worth checking out is hyperliquid dex, which mixes novel AMM curves with professional liquidity strategies. I’m biased towards venues that prioritize transparency and on-chain settlement, though each trader must do their own diligence.

FAQ

What distinguishes a decentralized perpetual from a centralized one?

Decentralized perpetuals settle on-chain and rely on smart contracts, oracles, and on-chain liquidators, which increases transparency but also adds complexities like oracle risk and MEV. CEX perpetuals often hide these dynamics behind off-chain matching engines and centralized custody, shifting the risk model.

How should I size leveraged positions?

Start small. Use position sizing rules that cap tail risk—percent of portfolio at risk per trade, not just leverage cap. Scale in and use spot hedges or smaller hedges across venues if you must maintain large exposure. Think in scenarios, not hopes.

Is high leverage ever a good idea?

Yes, for professional market-makers or traders with lightning-fast execution and firm risk controls. For retail traders, high leverage increases the chance of losing everything quickly. If you choose high leverage, have explicit exit plans and consider automated stop-loss strategies, but be aware of slippage and oracle-induced gaps.

So where does that leave you? Curious or cautious—both are okay. The big takeaway: perpetuals grant power, and power has costs. Trade with respect. Learn how funding, liquidity, and oracle design work together. Keep strategies simple. Admit uncertainty. (Oh, and by the way… keep a little capital aside for when things go sideways.)

On a final note—markets change. What worked in one regime will fail in another. On one hand that’s frustrating. On the other, it’s fascinating. I’m still learning. I hope this helps you trade smarter, not just harder. Somethin’ to chew on…